Janine Guillot, CEO, The SASB Foundation

As someone who started my career as a technical accountant and today leads a global sustainability accounting organisation, I have been immersed in the world of financial reporting longer than I care to admit. In my view, the IFRS Foundation’s Consultation Paper on Sustainability Reporting is the most significant development in accounting standard-setting since the creation of the International Accounting Standards Board (IASB) in 2001. This is big—and, therefore, crucial to get right.

There is good reason to believe the IFRS Foundation could do exactly that. At the Sustainability Accounting Standards Board (SASB), we support, in principle, the proposed creation of a new Sustainability Standards Board (SSB) under the Foundation. With its experience in international standard-setting and publicly accountable governance architecture, the Foundation is ideally positioned to establish authority and legitimacy around sustainability disclosure standards for capital markets, just as it did for financial reporting.

Of course, success will depend not just on what the Foundation does, but also on how it does so. In this regard, we’re also heartened by the Consultation Paper’s assessment of potential paths forward and the Foundation’s interest in working with established standard-setters and regulatory bodies. Although we will soon share our formal response to the Consultation Paper, this blog post summarizes key aspects of SASB’s preliminary perspective.

Meeting the Market Need

SASB was established—and our Standards were subsequently developed—to address a clear market need for consistent, comparable, reliable sustainability information that is material to enterprise value creation. It is our hope that the IFRS Foundation’s efforts will be carried out in a way that meets this market need. Encouragingly, the Foundation’s proposal does not suggest reinventing the wheel, but rather recognises the importance of building upon the established work of leading sustainability standard setters and framework providers.

In collaboration with CDP, the Climate Disclosure Standards Board (CDSB), the Global Reporting Initiative (GRI), and the International Integrated Reporting Council (IIRC), SASB recently co-authored a Statement of Intent to Work Together Towards Comprehensive Corporate Reporting. (“the Joint Statement”). We believe this shared vision can serve as a useful starting point for the Foundation’s work.

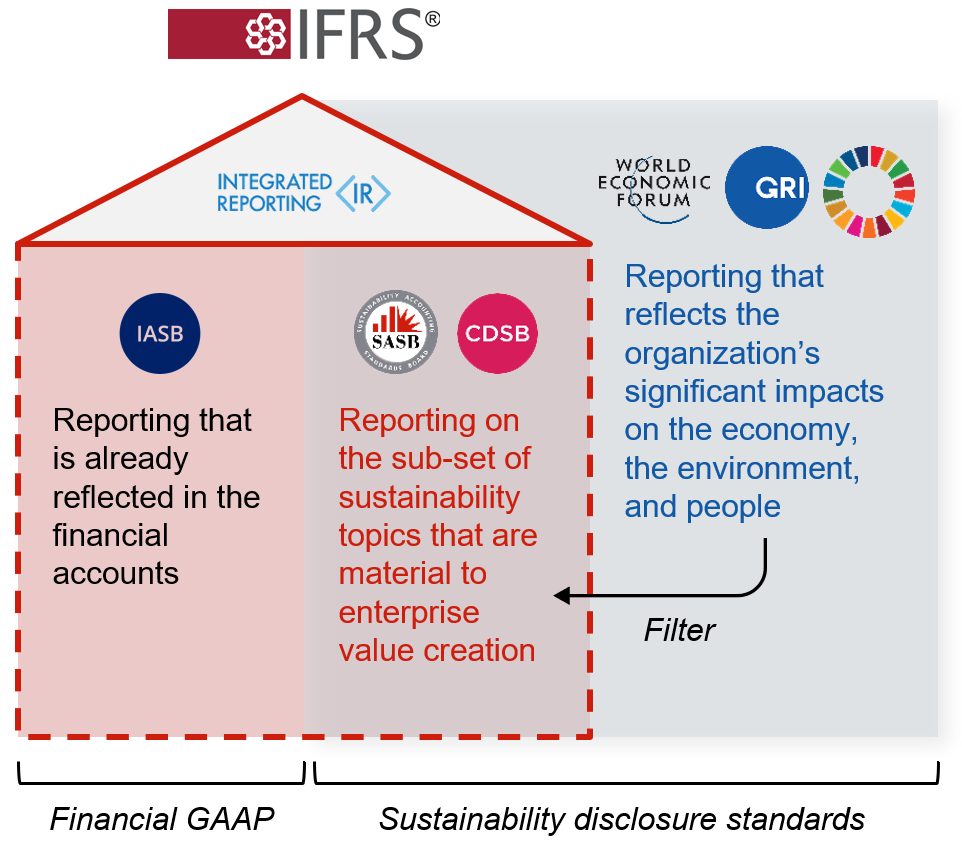

In support of our shared goal—a coherent, comprehensive system of corporate disclosure to achieve global comparability and reduced complexity—our Joint Statement identifies the key building blocks in that system and illustrates how they might fit together under the IFRS umbrella (See Figure 1). The Joint Statement envisions a system that addresses the market need in a variety of ways. For example, our proposed system combines the comparability of standardised quantitative metrics with the crucial contextual information provided by principles-based frameworks. It would also enable the Foundation to address the full range of sustainability factors that are material to enterprise value creation—E, S, and G—while also prioritising one of the most urgent of those issues: climate change.

The IFRS Foundation is proposing that the new SSB would sit alongside the IASB in the Foundation’s governance structure. The new SSB would focus on the needs of investors and other providers of capital for sustainability information that is relevant to enterprise value creation. We believe the new SSB could draw on the existing standards and frameworks already built for that purpose, including those of the IIRC, CDSB, SASB, and the Task Force on Climate-related Financial Disclosures (TCFD). These standards and frameworks focus their work on the sub-set of sustainability information that is most likely to be “financially material,” an approach that is well aligned with the Foundation’s objective to promote “high quality, transparent, and comparable information” to “help investors, other participants in the world’s capital markets, and other users of financial information make economic decisions.”

At the same time, the Foundation could benefit from the work that has already been initiated to begin to “build a bridge” between sustainability disclosure focused on financially material issues and corporate reporting that is focused on broader societal impacts and objectives, such as achieving the Sustainable Development Goals. This includes the work of GRI as well as the “stakeholder capitalism metrics” recommended by the World Economic Forum’s International Business Council. (See Figure 1.)

Figure 1. A Coherent, Comprehensive Corporate Reporting System

Broad Market Support

We’re encouraged that global capital markets have begun to embrace the shared vision articulated in our Joint Statement and recognise its alignment with the IFRS Foundation’s proposal. For example, Erik Thedéen, Chair of the International Organization of Securities Commissions (IOSCO) Sustainable Finance Task Force, wrote last week that, “While to date the two initiatives have been running in parallel, we are keen to see them come together. We consider the two initiatives to be highly complementary.”

Similarly, Kevin Dancey, CEO of the International Federation of Accountants (IFAC), has said, “We recommend that the [IFRS Foundation’s] proposed board adopt a ‘building blocks’ approach, working with and leveraging the expertise and disclosure requirements of the CDP, CDSB, GRI, IIRC, and SASB.”

Meanwhile, the Council of Institutional Investors (CII) has recently suggested that, “Market participants, non-governmental organisations, and governments can aid the success of these [independent, private-sector] standard setters by supporting their independence and long-term viability, attributes of which include: stable and secure funding; deep technical expertise at both the staff and board levels; accountability to investors; open and rigorous due process for the development of new standards; and adequate protection from external interference.”

As the CII statement suggests, setting standards is only part of the job. It will be equally important to maintain them. We believe our joint vision presents an opportunity for the IFRS Foundation to leverage not only the standards and frameworks that the collaborating organisations have developed over many years, but also the processes and expertise we have built up in the course of that work.

Looking Ahead

SASB Standards facilitate more informed decision making by investors and more efficient price discovery by capital markets. Through its proposal, we believe the IFRS Foundation can play a galvanizing role in achieving these objectives by bringing coherence—not complexity—to the sustainability disclosure landscape. As mentioned earlier, we support the IFRS Foundation’s proposal in principle, but how the proposal is implemented matters. With this in mind, our preliminary views are that the new SSB will need to be committed to the following to fully meet capital market needs and ensure success:

- Addressing the full range of sustainability factors that are material to enterprise value creation (e.g. environmental, social, human capital and governance disclosures);

- Developing standards that include quantitative metrics/key performance indicators;

- Developing industry-specific standards;

- Leveraging existing sustainability frameworks/standards and processes that have broad capital markets support;

- Building a funding model that can sustain high-quality, global standards development;

- Developing the relationships and expertise necessary to develop standards for financially material sustainability disclosure, which often require broader experience and knowledge sets than that used for financial accounting standards development;

- Establishing processes to maintain an XBRL taxonomy for sustainability disclosure standards; and

- Establishing processes to achieve interoperability with sustainability standards focused on multi-stakeholder communication.

The IFRS Foundation’s consultation is open for comment until 31 December 2020. In the meantime, we thank the Foundation Trustees for their leadership in taking this important step, and we welcome this significant progress toward a global solution for companies, investors, markets, and the world at large.