The International Sustainability Standards Board (ISSB)’s inaugural standards—IFRS S1 and IFRS S2—mark the beginning of a new era of sustainability-related disclosures in capital markets worldwide. The ISSB Standards will help to improve trust and confidence in company disclosures about sustainability to inform investment decisions.

And for the first time, these Standards create a common language for disclosing the effect of climate-related risks and opportunities on a company’s prospects.

The ISSB Standards were issued on 26 June, officially launched by ISSB Chair Emmanuel Faber at the IFRS Foundation’s annual conference and through a week of events hosted by stock exchanges around the world.

About the ISSB Standards

IFRS S1 provides a set of disclosure requirements designed to enable companies to communicate to investors about the sustainability-related risks and opportunities they face over the short, medium and long term.

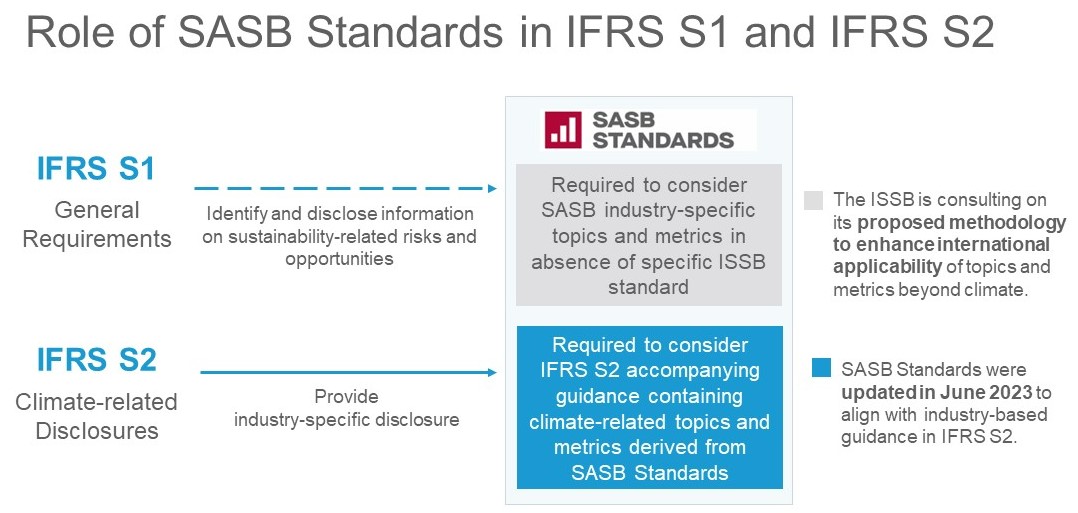

IFRS S2 sets out specific climate-related disclosures and is designed to be used with IFRS S1. IFRS S2 includes accompanying guidance derived from the climate-related topics and metrics in the SASB Standards.

Both IFRS S1 and IFRS S2 fully incorporate the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD).

How the updated SASB Standards support ISSB disclosure

The ISSB Standards require industry-specific disclosures and the SASB Standards have a prominent role in helping companies to apply IFRS S1 and IFRS S2.

- IFRS S1 requires companies to consider the SASB Standards to identify sustainability-related risks and opportunities and disclose related information.

- IFRS S2 provides accompanying guidance derived from the climate-related topics and metrics in the SASB Standards. This guidance has been enhanced to improve international applicability.

As such, the ISSB has committed to maintain, enhance and evolve the SASB Standards and encourages preparers and investors to continue to use them.

An initial phase of SASB Standards enhancements is underway to improve the international applicability of the non-climate related disclosures. There is an open consultation on this set out in the Exposure Draft Methodology for Enhancing the International Applicability of the SASB Standards and SASB Standards Taxonomy Updates.

Secondly, this week, the ISSB released updated SASB Standards to align the climate-related topics and metrics with the industry-based guidance in IFRS S2. This targeted update:

- added new topics and metrics covering financed emissions in three industries – Asset Management & Custody Activities¹, Commercial Banks and Insurance;

- revised 12 metrics to enhance international applicability; and

- removed six metrics that were not internationally applicable.

Download the Staff Paper prepared for the May ISSB meeting to see a list of the metrics in question. View a timeline of the planned milestones for enhancing the international applicability of the SASB Standards.

Adoption of the global baseline

Adoption of the global baseline

This support for a comprehensive global baseline of sustainability-related disclosures demonstrates the widespread demand for a consistent understanding of how sustainability factors affect companies’ prospects.

Now that IFRS S1 and IFRS S2 are issued, the ISSB will work with jurisdictions and companies to support adoption. The first steps will be creating a Transition Implementation Group to support companies that apply the Standards and launching capacity-building initiatives to support effective implementation.

The ISSB will also continue to work with jurisdictions wishing to require incremental disclosures beyond the global baseline and with GRI to support efficient and effective reporting when the ISSB Standards are applied in combination with other reporting standards.

The 77 industry-based SASB Standards enable companies to provide decision-useful, comparable information in a cost-efficient way, as evidenced by their use in over 2,800 companies in more than 70 jurisdictions around the world, including 72% of the S&P Global 1200 Index. The SASB Standards are integral to the ISSB Standards, and their continued use will support companies on the path to ISSB implementation. Read more.

IFRS Sustainability licensing opportunities help investors, data and research firms, and corporate reporting software providers IFRS Sustainability intellectual property to focus their processes and products on the ESG information that matters to investors. Learn more.

Stay updated on the ISSB’s work and opportunities to get involved. Subscribe for news alerts.

[1] Please note, new topics and metrics covering financed emissions apply to asset management but not custody activities, although they are grouped within the same industry.