Arturo Rodriguez, Special Projects Manager at SASB

Effective decision making is a mix of art and science, a delicate balancing act between professional judgment and empirical analysis—both are important. However, when it comes to corporate sustainability, today’s investors are long on experience and intuition, but often short on robust data to inform their research.

This state of affairs has been the subject of much scrutiny, often resulting in the conclusion that the quality of corporate reporting on ESG (environmental, social, and governance) and sustainability factors simply isn’t up to par. While this widely held notion might be rooted in truth, SASB’s most recent publication, ESG Uncovered, shows that when you dig a little deeper the problem is considerably more nuanced.

In a recent analysis, SASB found that, in some cases, companies are indeed reporting information on the financially material sustainability topics covered by SASB standards, but those data are not being collected by the third-party providers on which investors rely.

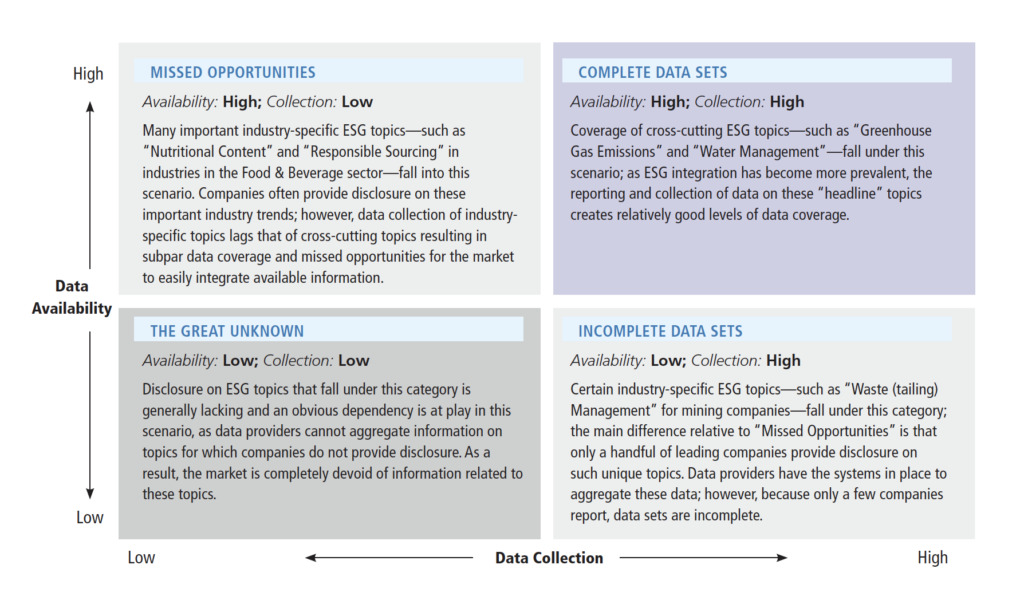

As this scenario illustrates, good data coverage is a function of two key variables:

- Data availability: the ESG information that companies report; and

- Data collection: the ESG information that data providers aggregate.

Because of this dynamic, when investors start looking for ESG data, they will face one of four different scenarios: (1) complete data sets, (2) missed opportunities, (3) incomplete data sets, and (4) “the great unknown,” a data frontier, marked by low amounts of reporting and low amounts of collection. (See table below.)

ESG Data Coverage as a Function of Availability and Collection

So, what are the implications for investors? They are twofold.

- Start using SASB-aligned data now. First, a significant amount of data is already being reported that is well-aligned with the SASB standards and is available for use by investors today. For example, our analysis of one widely used third-party provider indicates that data collection mechanisms are already in place for information aligned with more than half of the SASB metrics. Investors need not wait to integrate these data into their analyses, products, and decision making.

- Exercise your influence—on both parties. Secondly, investors have a dual opportunity for improving ESG data coverage by engaging two key agents of change. As the paper notes, by identifying which ESG issues are characterised by which types of reporting and aggregation practices, “investors can more efficiently and effectively shape their strategies for engagement with companies (on issues with a lack of available data), with data providers (on issues that lack coverage), or with both.” The key to improving ESG data sets is understanding which type of improvement is needed on which issues and in which industries.

Sustainable Finance Week, which is partly dedicated to emerging trends in the ESG space, is the right time to get this conversation started. However, meaningful market movement will require sustained effort over the long term, and SASB is here to provide critical support. With the recent codification of the SASB standards, markets have established infrastructure that can serve as a platform for improving both of the key variables that influence data coverage. By providing a common set of decision-useful, cost-effective performance metrics, the SASB standards should help key links in the “informational supply chain” come into closer alignment over time.

We invite you to download ESG Uncovered, consider how its findings may support your work, and help shape a future in which more effective ESG integration fuels improved decision making and more efficient, stable, and resilient capital markets.