Authored by Jeff Cohen, CAIA, Director of Capital Markets Integration, Head of Private Investment Initiatives

Companies working to improve sustainability performance may have an opportunity to leverage sustainability disclosure to access a rapidly growing area of credit markets through sustainability-linked financing.

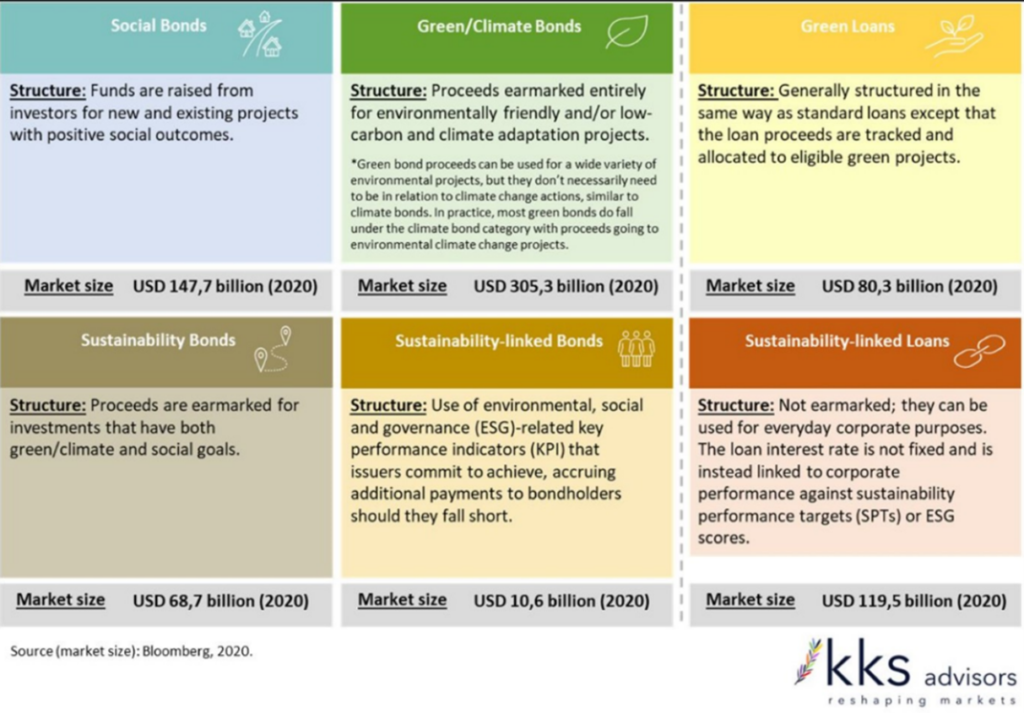

To date, most ESG debt exists in the form of green bonds or other thematic bonds or loans. However, such instruments represent just one of several options in the ESG debt market, each with key functional differences.

Thematic bonds such as green bonds are typically used to fund specific projects with sustainability outcomes. The proceeds of sustainability-linked bonds, however, are not restricted. Rather than directly funding a specific social or environmental project, sustainability-linked products are used by lenders to incentivize the sustainability performance of the borrower itself (see table below).

Reprinted with permission from KKS Advisors, via the KKS Advisors Blog

Reprinted with permission from KKS Advisors, via the KKS Advisors Blog

This key difference highlights why the SASB Standards lend themselves well to supporting performance tracking for sustainability-linked debt instruments. With industry-specific SASB disclosure standards, lenders can be confident that sustainability-linked KPIs measure ESG performance on the topics most relevant to the issuer’s risk profile.

A rapidly growing number of major companies have announced ambitious goals related to achieving net-zero emissions, supporting the UN Sustainable Development Goals, hitting science-based targets, prioritising diversity and inclusion, or otherwise performing highly on key dimensions of sustainability. Where such goals are relevant to enterprise value, an untapped opportunity to access financing through sustainability-linked bonds (SLBs) and sustainability-linked loans (SLLs) may exist. As a tool for disclosing, benchmarking, and tracking company performance on financially material ESG risks and opportunities, the SASB Standards can help companies communicate how they’re managing ESG issues that drive value in their industry, and thus help companies tap into this expanding pool of capital.

The Rapid Growth of Sustainability-Linked Debt Products

According to a Moody’s forecast, sustainable bonds may represent 8 to 10 percent of total global bond issuance in 2021— up from 5.5 percent of total issuance in 2020. The sustainable debt market is growing fast, and SLBs and SLLs are significant drivers of that growth.

This has contributed to credit rating agencies and banks’ credit rating committees increasingly factoring ESG risks into their ratings and determinations. As stated in a Lawdragon press release, Wachtell Lipton: Sustainable Finance Comes to the Fore, “The credit markets have sent two unequivocal messages as companies increasingly signal their commitment to accountability on ESG issues: (i) ESG risk is credit risk and (ii) investors are willing to pay modest subsidies to support progress on ESG issues.”

Issuance Across Industries

Unsurprisingly, financial services firms have pounced on the opportunity to improve their cost of debt. As reported an a 2020 Bloomberg article, Neuberger Berman became the first financial services firm in North America to link its own cost of debt to ESG factors through a sustainability-linked loan. The loan is benchmarked annually and priced according to metrics that measure material ESG issues, including its rating scored by the UN Principles of Responsible Investing (PRI), diversity metrics in executive leadership, and others.

More recently, in February of this year, the Carlyle Group announced that it had secured “the largest ESG-linked private equity credit facility in the US for $4.1 billion and the first to focus exclusively on advancing board diversity.” In this facility, cost of debt is tied to Carlyle’s goal of achieving 30 percent board diversity among its Americas portfolio companies. When tracked year-over-year, KPIs reveal that the average earnings growth in Carlyle portfolio companies is reliably higher (approximately 12% greater per year) among those with more diverse boards.

The Financials sector is not the only one capitalizing on sustainability-linked debt. Industries raising sustainability-linked loans exist across industry type and share size (see table below).

Top 5 Sectors and Raising Debt Through Sustainability-Linked Loans

|

Sector |

Percent of all SLLs issued |

|

Utilities |

14% |

|

Transportation & Logistics |

9% |

|

Chemicals |

7% |

|

Industrial Other |

6% |

|

Food & Beverage |

5% |

Source: Bloomberg and Nordea via Open Insights by Nordea

Industry Associations Provide Authoritative Guidance to Issuers

To support issuers and lenders across industries, a number of leading industry associations have developed principles to clarify and establish common best practices for the use of sustainability-linked bonds and loans.

The International Capital Market Association’s (ICMA) Sustainability-Linked Bond Principles (SLBP) offer guidance specific to bonds. In the loans market, the Loan Market Associate (LMA), the Loan Syndications and Trading Association (LSTA), and the Asia Pacific Loan Market Association (APLMA) co-developed and launched the Sustainability-Linked Loan Principles (SLLP). Each set of principles is customised according to their respective instrument’s unique characteristics, however both rely on a highly similar set of core concepts, including:

- The selection of Key Performance Indicators (KPIs) that are relevant to the issuer’s overall business

- Target setting using pre-defined sustainability performance targets (SPTs). These represent the performance goal or target the company aims to achieve, while KPIs measure progress against that goal.

- Bond/loan financial and structural characteristics (such as variation of the coupon) depend on performance measured using KPIs and tracked against the sustainability performance targets.

- Regular, verifiable reporting to investors

The Role of Standards

In alignment with best practices, SASB Standards can help companies select KPIs relevant to sustainability-related risks and opportunities and help to streamline investor-focused disclosure by leveraging existing reporting processes. The Standards can further help to mitigate challenges posed by immaterial sustainability data in debt markets.

1. Providing meaningful, consistent, reliable KPIs: For KPIs to be useful, they should measure topics that are material to the issuer’s current and future performance and prospects. For performance target categories recognised by the SLL Principles, SASB Standards can support useful disclosure for SLLs, as they offer valuable insight through comparable and complete metrics for the sustainability topics most relevant to companies in a given industry.

For example, the SLL Principles provide a reference list of common sustainability performance target categories in Appendix I of the Principles document, which includes Energy Management, Affordable Housing, and many others. To disclose on the topic of Energy Management in the Building Products & Furnishings Industry, companies can use SASB metrics such as: (1) total energy consumed, (2) percentage grid electricity, and (3) percentage renewable. Or, for Affordable Housing in the Commercial Banking industry one could use the following SASB metrics: (1) number and (2) amount of loans outstanding qualified to programs designed to promote small business and community development.

However, materiality and relevance to the business model are not the only important characteristics of sound KPIs. According to the SLB Principles, they should also be quantifiable on a consistent methodological basis, externally verifiable, and able to be benchmarked. SASB technical protocols directly enable methodological consistency and external verification by providing clear direction on how to properly capture and disclose data for each accounting metric, forming a basis for suitable criteria for external assurance and ensuring consistent application over time and across companies.

2. Leveraging Existing Reporting Processes: The principles developed for both sustainability-linked bonds and loans encourage issuers to select KPIs that are already being collected and reported through annual reports, sustainability reports, or other non-financial disclosures. Issuers can leverage existing processes to mitigate the cost of disclosure and, at the same time, use KPIs that are presumably already backed by sound rationale for their materiality and relevance to the issuer’s business model.

The SLL Principles also encourage issuers to disclose the sustainability standards or certifications “to which they are seeking to conform.” To promote transparency, the principles encourage borrowers to publicly report information related to their sustainability performance targets, which is often included in annual or sustainability reports. For private companies, such disclosure may take the form of reporting to their lender group, fiscal sponsors, and limited partners.

3. Enhancing Market Credibility: Leveraging existing sustainability disclosure, or those disclosure standards to which issuers seek to conform, presents an opportunity for issuers to tap into growing pools of additional financing while limiting the cost burden of disclosure per SLB and SLL principles. Yet, more-streamlined sustainability disclosure of financially material KPIs can yield broader market benefits as well. The credibility of the SLB and SLL market hinges on focused, quality disclosure. The success of the instrument, according to the SLB Principles, is improved where issuers minimise the disclosure of KPIs that do not credibly measure performance and support comparative risk and opportunity analysis, which has been linked to an array of analytical challenges for providers of capital for other ESG data sources (for more detail, see the SASB blog post on the new “Uses of ESG Workshop” series).

SASB Standards offer KPIs that lenders can use to reliably inform deal structuring decisions and investors can rely on for their consistency and focused scope of disclosure. By tying company sustainability commitments to performance targets measured against an independent standard, SLB & SLL issuers can demonstrate their accountability to achieving pre-defined targets while also meeting investor information needs through disclosure.

When it comes to sustainability-linked bonds and loans, standardised ESG disclosure does not represent an obligation, but an opportunity. SASB Standards can help issuers more-effectively communicate with lenders and creditors and improve cost of capital while making progress toward broader company sustainability pledges.