During Friday’s public meeting of the SASB Standards Board, staff provided a status update on a project initiated in September 2019 to refresh the SASB Conceptual Framework. From its inception, the project has aimed to articulate the Standards Board’s core principles more clearly, rather than to substantively alter them.

Background

As part of the project, the Board approved and issued an exposure draft in August 2020 to solicit public feedback on proposed revisions. The public comment period ended on December 31, 2020, and staff presented the Board with a summary of the public comments received in February 2021.

In response to the public comments received, at our October 1 public Board meeting the Board and staff discussed two key areas for further improvement in our governance documents. One area relates to the term “financial materiality,” and the other relates to where the Standards Board discusses its “fundamental tenets.”

Materiality

Staff noted pervasive and ongoing market confusion regarding the term “materiality,” and public comments suggest that part of the confusion comes from two different uses of the term. In particular, the Conceptual Framework:

- Primarily uses the term “financial materiality” as shorthand for the type of sustainability information that the SASB Standards Board targets for its standards given its focus on the information needs of investors and creditors; and

- Also uses the term “material” to clarify the Standards Board’s longstanding position that, in implementing the Standards, companies make their own determinations on materiality based on their specific facts and circumstances and consistent with applicable laws and regulations.

While the second use of the term isn’t the primary way in which we have intended to use the phrase “financial materiality,” it is the most traditional use of the term materiality. As a result, using “financial materiality” as shorthand is easily misunderstood as being about defining a threshold for disclosure.

Both the International Accounting Standards Board (IASB) and the Financial Accounting Standards Board (FASB) have, for decades, used a different term to communicate the type of information their standards are intended to help produce: relevant. In their respective Conceptual Frameworks, both IASB and the FASB reference materiality as an entity-specific aspect of the broader concept of relevance. We do not disagree with that approach – nor have we ever – so the time seems right to consider making that agreement more explicit.

As Board member Elizabeth Seeger noted during the meeting, “one of the biggest impediments” to clarity and coherence around sustainability disclosure “is the lack of precision and shared terminology.” Indeed, like Board member Susanne Stormer said, “Words do matter.”

By improving our language, we can more clearly articulate how the Standards Board has always viewed materiality and align more closely with financial standard setters, who share a common, investor-focused objective. As global capital markets move toward a more coherent, comprehensive system of financial and sustainability disclosure, Board members expressed the view that such alignment across standard setters and framework providers is increasingly important. This need has been underscored in the Value Reporting Foundation’s ongoing participation in the IFRS Foundation’s Technical Readiness Working Group.

Fundamental Tenets

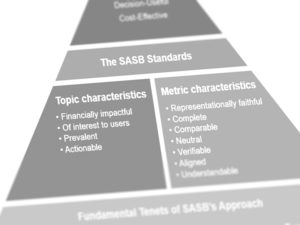

Additionally, staff noted consistent market feedback indicating that the “fundamental tenets” outlined in the Conceptual Framework may be more appropriate to include in the Standards Board’s Rules of Procedure. Public comments received pointed out that the fundamental tenets – evidence based, market informed, industry specific, and transparent – are, generally speaking, more accurately framed as characteristics of our standard-setting due process rather than as concepts that guide our decision making.

Staff further suggested a key implication of this proposed change: the importance of ensuring that industry specificity is appropriately captured in the Conceptual Framework. Board members shared a range of views on how various other concepts – including “relevance,” “prevalence,” and “financially impactful” – may sufficiently capture the fact that sustainability risks and opportunities manifest differently based on the resource dependencies and impacts associated with a given set of economic activities or typical business model.

Board members’ comments encouraged further consideration of how the Conceptual Framework articulates – or might more effectively articulate – how the Board weighs the trade-offs in considering whether to tailor disclosure to an industry context and “where we draw the line.” This may include ensuring key concepts incorporate business models and business activities. As Board member Lloyd Kurtz pointed out, it must be acknowledged that, while useful, “industry [is] an imperfect organizing principle.”

Looking Ahead

Friday’s public discussion was intended to apprise the Standards Board of staff’s progress in considering important feedback, suggest potential paths forward, and open re-deliberation on these key points. Although no formal proposals or Standards Board votes are imminent, the Board and technical staff will continue to evaluate these and other potential revisions – particularly in the context of the substantial developments currently underway within the sustainability disclosure landscape.

Any future changes to the Conceptual Framework will seek to improve the articulation of core concepts without in any way altering the fundamental role or purpose of the SASB Standards, which is – and will continue to be – facilitating decision-useful information to investors that is relevant to enterprise value.

Jeff Hales is Chair of the SASB Standards Board.