Katie Schmitz Eulitt, Director of Investor Outreach

At SASB, we frequently hear misconceptions about our standards, including misconceptions about who uses them and how to use them. Many of these “SASB myths” arise in conversations that members of our SASB Standards Investor Advisory Group (IAG) have with companies who are considering using SASB standards. We are hoping to clear up market confusion by dispelling some of the top 11 SASB myths we consistently hear in conversations with companies and others.

Myth #1: SASB standards are only relevant to US companies and investors.

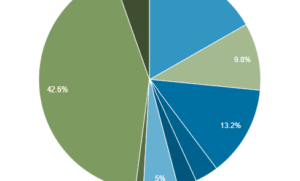

Reality: Businesses and investors around the world use SASB standards to better identify, manage, and communicate about financially material sustainability risks and opportunities. There is strong, growing support for SASB across markets. For example, as of June 2020:

- 45% of companies reporting ESG performance to investors via SASB standards are domiciled outside the US.

- SASB’s Standards Advisory Group—comprised of industry experts who advise SASB on emerging issues related to standard-setting—has representatives from 22 countries (36% of members represent companies domiciled outside the US).

- SASB Standards Investor Advisory Group (IAG) includes 50+ institutional investors with approximately $41T in assets. SASB Standards IAG members represent 12 countries (43% of members are domiciled outside of the US).

- Of the ~480,000 downloads of SASB standards, 51% are from outside the US (and, this number is trending up; 66% of 2020 downloads to date have been from entities outside the US).

More than three-quarters of SASB metrics are appropriate for use by companies and investors globally, and the remaining metrics are under review to enhance their global applicability.

Myth #2: SASB standards are complex and expensive to implement.

Reality: SASB standards are designed to provide a cost-effective way for companies to disclose material, decision-useful sustainability information to investors. On average, each industry standard has just six disclosure topics and 14 metrics, drawing from commonly used performance metrics wherever possible. For guidance on how to use SASB standards, see the SASB Implementation Primer.

Myth #3: SASB standards are not designed for companies that straddle multiple industries.

Reality: While SASB classifies companies into a single primary industry in our Sustainable Industry Classification System® (SICS®), that should not prevent companies from using multiple industry standards, as a growing number of companies do. If a company’s consolidated operations span multiple industries, or if a company’s business model defies traditional industry classifications, SASB recommends reviewing multiple industry standards to identify topics beyond those defined in its primary industry standard that may warrant disclosure to investors. (SASB is also working to include non-primary industry classifications via SICS.) Examples of multiple-industry companies that report using SASB include MOL Group, BMO Financial Group, and Netflix. For more information, please see the “Determine Which Industry standards Apply” section of the SASB Implementation Primer.

Myth #4: SASB standards compete with GRI standards.

Reality: SASB and GRI are mutually supportive and are designed to fulfil different purposes. SASB standards focus on ESG issues expected to have a financially material impact on the company, aimed at serving the needs of most investors. GRI standards focus on the economic, environmental, and social impacts of the activities of a company, and hence its contributions–positive or negative–towards sustainable development, which is of interest to a broad range of stakeholders, including investors. Many companies use both SASB standards and GRI standards to meet the needs of their audiences—for example, ArcelorMittal publishes SASB and GRI disclosures within the same integrated report, as do the PSA Group and Diageo. Nike publishes a GRI-focused report and a SASB summary. SASB encourages companies to focus on which stakeholders need what information for what purpose and align their GRI and SASB reporting accordingly. For more information, please see the “Understand Audience Needs and Expectations” section of the Implementation Primer.

Myth #5: SASB is a commercial organisation and companies must pay to use its standards.

Reality: SASB is a 501(c)3 non-profit organisation. All SASB standards are available to download free of charge on the SASB website for non-commercial use, such as reporting to investors.

Myth #6: SASB-based reporting must go in regulatory filings.

Reality: Companies communicate with investors in many ways, all of which may be appropriate channels for using SASB standards. Companies may opt to disclose SASB data through a variety of channels, including annual reports to shareholders, integrated reports, sustainability reports, stand-alone SASB reports, regulatory filings, and investor relations websites. For more information, see the “Deciding Where to Disclose” section of the SASB Implementation Primer. For examples of how companies are using SASB in a variety of reports, see Companies Reporting with SASB Standards.

Myth #7: Companies must disclose every topic and metric in its industry standard(s).

Reality: A company determines for itself which SASB standard or standards are relevant to the company, which disclosure topics are financially material to its business, and which associated metrics to report. When a company determines that a sustainability topic is financially material to its business, SASB’s voluntary standards offer a way to standardize disclosure on that topic, for the benefit of both companies and investors. SASB’s Standards Application Guidance¹ recommends that when a company omits or modifies a SASB metric, it discloses its rationale for doing so. For more information on determining which disclosure topics and associated metrics to disclose, see the “Determine Which Disclosure Topics Are Applicable” section of the SASB Implementation Primer.

Myth #8: SASB reports must be checked for compliance by SASB.

Reality: As a standard-setting organisation, SASB does not offer any type of compliance evaluation or certification for reporting companies. Each company decides what industry standard(s) to use and which topics and metrics to report, based on its determination of what is financially material to the company.

Myth #9: The world is changing too fast for a company to be locked into ESG standards from 2018.

Reality: SASB’s standard setting is an iterative process and the standards will evolve over time. SASB approaches updates to the standards using a project-based model, enabling standard setting to effectively address broad themes, regulatory changes, and other trends which affect multiple sectors. In fact, ten research and standard-setting projects are currently underway. To see active projects, click here.

Myth #10: SASB rates companies.

Reality: As an independent standard-setting organisation, SASB does not rank, rate, or evaluate the sustainability performance of companies.

Myth #11: SASB is only useful for publicly listed companies.

Reality: Because the issues covered in SASB standards are closely linked to financial fundamentals, the standards are being used by both public and private companies and are also used by investors across a full range of asset classes, including both public and private equities and fixed income. For more information, see the SASB and Private Markets white paper.

¹Please note: Entities using the SASB Standards as part of their implementation of ISSB Standards should consider the relevant ISSB application guidance.